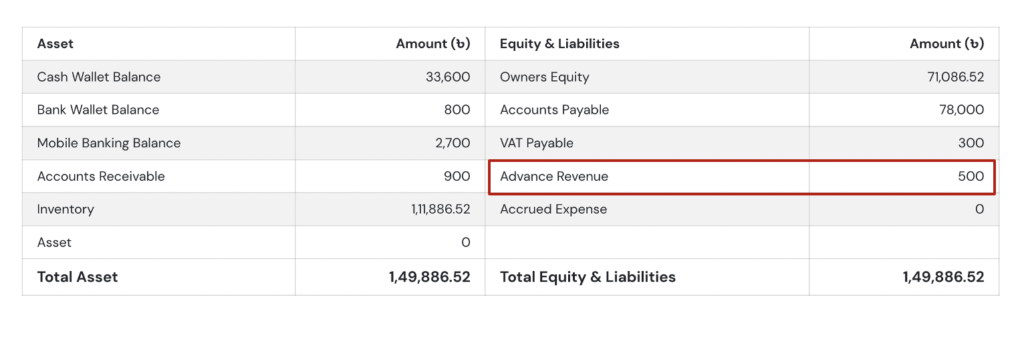

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It can be thought of as a “prepayment” for goods or services that a person or company is expected to supply to the purchaser at a later date. This revenue is not actually a revenue rather a liability. This is recorded as Advance Revenue under Current Liability Section in the balance sheet.

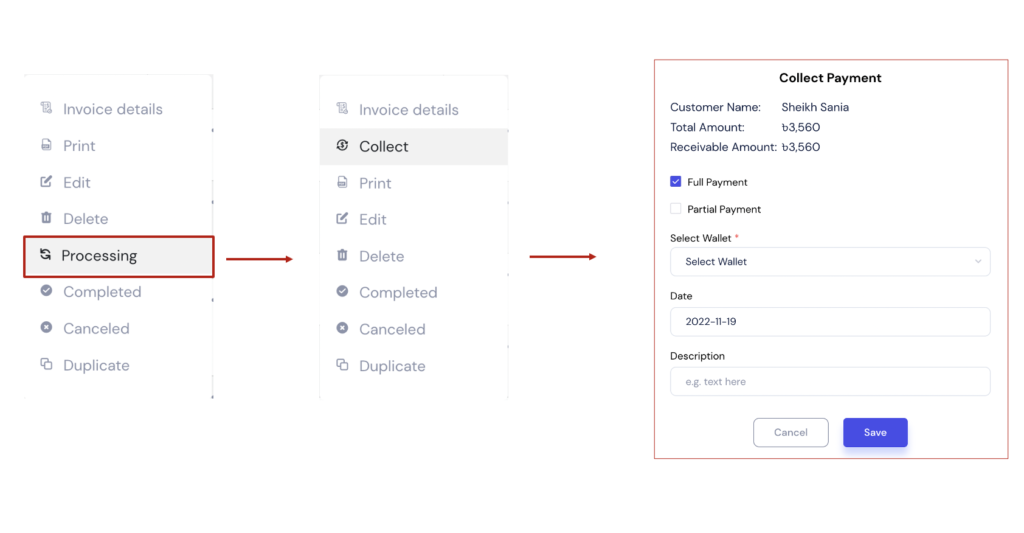

You can now record any advance revenue amount in our software without completing any invoice. Just update your invoice from pending to processing and you will get an option to collect against that invoice which will be marked as advance revenue until you complete the invoice.

Until we complete this invoice this advance received amount will have no impact in Income statement since it’s not actually a revenue. It will be reported in the balance sheet as a liability under current liability.

Once we complete the invoice after we deliver the product or service, this unearned revenue becomes an actual revenue and then it will be reported in the Income Statement as a revenue and get removed from current liability. But if we cancel the invoice and don’t refund the received amount then this advance amount is reported as ” other income” in the Income Statement.

Questions? Please email us to: info@smevai.com