Operating Profit Margin, also known as operating margin or operating income margin, is a financial metric that measures the profitability and efficiency of a company’s core operations. It provides insights into how well a company is managing its operating expenses in relation to its total revenue. A higher operating profit margin generally indicates that a company is better at controlling its operating expenses.

Here’s the formula to calculate the operating profit margin:

Operating Profit Margin = (Operating Profit / Total Revenue) * 100

Here’s a breakdown of the key components:

- Operating Profit (Operating Income): This represents the profit a company makes from its core business activities. It is calculated as follows: Operating Profit = Gross Profit – Operating Expenses

- Gross Profit is the revenue left after subtracting the cost of goods sold (COGS) from total revenue. It reflects the profitability of a company’s core goods or services.

- Operating Expenses include all the expenses associated with running the day-to-day operations of the business, such as salaries, rent, utilities, marketing, and depreciation. These are the costs incurred in the normal course of business.

- Total Revenue: This represents the total income generated by the company from sales, including revenue from goods or services sold, discounts, and returns.

The operating profit margin is a useful metric for evaluating a company’s efficiency in generating profit from its core business activities. It helps assess how well a company controls its operating expenses and is a key indicator of operational efficiency. A higher operating profit margin suggests that a company is more effective at managing its costs and generating profit, which is generally favorable for investors, stakeholders, and management.

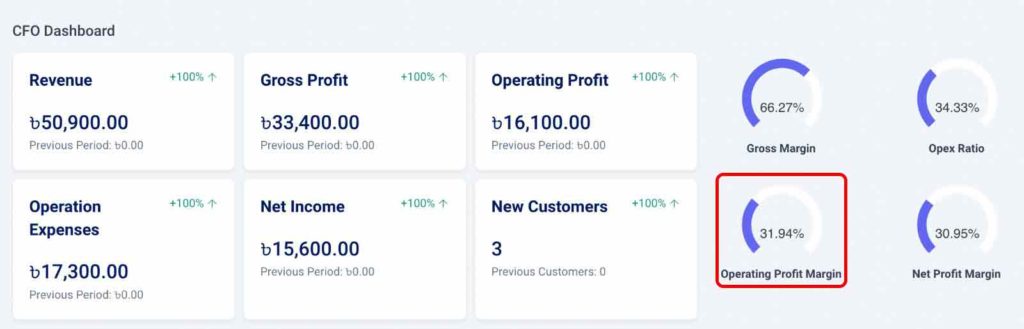

You can find your operating profit margin very easily in our SME Hihsab Software. In the CFO Dashboard of your account it gets automatically calculated and reported like this for the selected time period.

You can also manually calculate it from your income statement as per given formula.